Flychain newsletter for August and September 2024

More customers, more partners, and more conferences

Highlights

Platform adoption and development

In the last two months, we’ve signed an additional 11 customers to our platform, bringing our total to 24 customers since launching in April.

Customer requests, specifically around healthcare analytics that only Flychain can calculate (combining billing, payroll, and expense data), have become a point of focus for us as we deepen our offering specific to the healthcare space. Metrics like profitability per care instance, employee, and service line have been requested by roughly ⅔ of our customers.

Partnerships

Since bringing on Simone, we’ve signed partnerships with Raven Health and TherapyIQ, with a few more exciting partnerships on the horizon that we’ll announce in the coming months. Stay tuned!

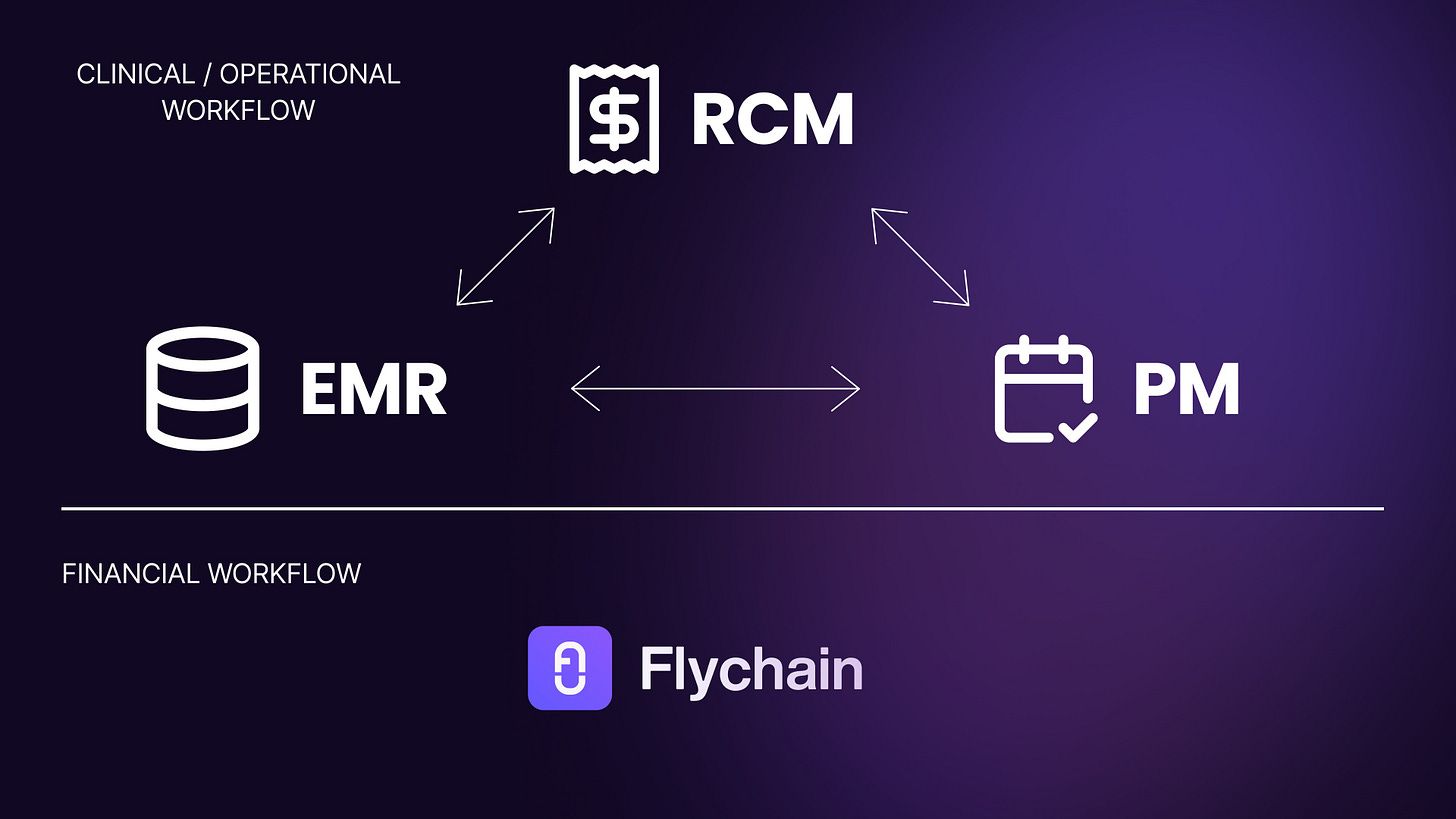

Our platform has enabled us to seamlessly move to other healthcare verticals (e.g. skilled nursing, anesthesiology) through a few new general channel partners. The appetite to partner with Flychain has increased, as our positioning alongside the current “clinical tech stack” has resonated with EMRs, RCM, and Practice Management (see the diagram below).

Moving Up Market

We now have 4 multi location healthcare entities, further demonstrating the up market pull, which has lead to larger ACVs. We’ve spoken to a few search funds, who intend to work with Flychain as they roll up more SME healthcare providers. This is exciting, as with each acquisition, our contract values increase without having to acquire new customers.

Kantime Conference + CEO Homecare Summit

In July, the Flychain team headed to Dallas as sponsors of the Kantime Conference. Kantime is a leading EMR in the Home Health + Hospice industry.

We’ve already signed one multi-location Hospice group on the back of the conference, which sets the stage for a more formal Kantime partnership in the near future.

In August, we headed down to a CEO retreat for Homecare + Home Health owners. We spent two full days listening and learning from CEOs.

Key metrics

Graphs

Note: the dip in SaaS revenue in September is due to 3 late payments from customers, which we collected in October. Also, we signed 3 new customers since the beginning of October - these new customers are not reflected in the graphs below.

Financials

Net Burn

$60,000

Bank balance

$1,990,865.89

Runway

2.8 years